How AML Software Can Simplify Client Onboarding for Accountants and Bookkeepers

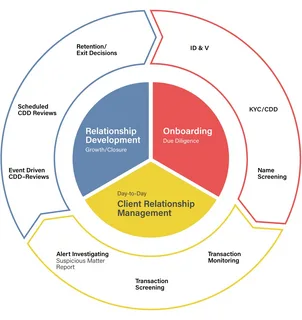

Client onboarding is one of the most critical processes for accountants and bookkeepers. It’s the stage where you verify identities, assess risks, and ensure compliance with anti-money laundering (AML) regulations. For many professionals, this process can be time-consuming, prone to errors, and a source of regulatory risk. That’s where AML software for accountants and bookkeepers can transform the onboarding experience.

Why Onboarding Compliance Matters

Under UK regulations, firms are required to perform due diligence on new clients. This includes verifying identities, screening against sanctions lists, and monitoring for unusual activity. Failing to meet these requirements can lead to fines, reputational damage, or even criminal liability. Manually handling these checks often slows down onboarding and increases the chance of mistakes.

How AML Software Helps

Modern AML software streamlines client onboarding by automating many of these compliance tasks. For example, identity verification tools can cross-check clients against multiple databases in seconds, while risk assessment modules automatically flag high-risk individuals or entities. This reduces human error and ensures that all checks are thoroughly documented.

Time-Saving Automation

One of the biggest benefits of using AML software for accountants and bookkeepers is the efficiency it brings. Manual onboarding can take hours or even days per client, particularly for international clients. Software automation accelerates this process, allowing firms to onboard clients quickly without compromising compliance. Automated alerts and reporting further reduce administrative burden, freeing up time for advisory work.

Enhanced Client Experience

Fast, seamless onboarding is not just about compliance—it also improves client satisfaction. Clients expect professional and efficient services, and delays in onboarding can create frustration or even lead to lost business. With AML software, accountants and bookkeepers can provide a smooth, secure onboarding experience, boosting client confidence from day one.

Maintaining Ongoing Compliance

Onboarding is just the beginning. Many AML software solutions continue to monitor client accounts and transactions, ensuring ongoing compliance. This continuous monitoring helps detect suspicious activity early and keeps firms prepared for audits, all without manual effort.

Choosing the Right AML Software

When selecting AML software, it’s important to choose a solution designed specifically for accounting and bookkeeping professionals. Look for features like automated identity verification, risk scoring, regulatory reporting, and seamless integration with your existing systems. A vendor with strong support and regular updates ensures that your firm stays compliant as regulations evolve.